are funeral expenses tax deductible in australia

Qualified medical expenses include. Funeral expenses are not tax deductible because they are not qualified medical expenses.

Are Funeral Costs Tax Deductible In Australia Ictsd Org

When it comes to funeral costs themselves including burial and other important areas the determining factor in whether tax deductions are available is the source of payment for these costs.

. This person may be an executor or administrator who has been granted probate or letters of administration by a court. This means that you cannot deduct the cost of a funeral from your individual tax returns. This cost is only tax-deductible when paid for by an estate.

This means that you cannot deduct the cost of a funeral from your individual tax returns. Funeral Expenses and Estate Settling. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

They are never deductible if they are paid by an individual taxpayer. While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. According to IRS an individual taxpayer may deduct medical expenses on the tax return but cant deduct funeral costs.

It is legal to deduct from the gross estate funeral expenses administration fees and any debts incurred by the estates administration Code Sec. Deducting funeral expenses as part of an estate. For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form.

However if you have a group life insurance policy cover held through a superannuation fund the rules are slightly different. The Australian Taxation Office ATO advises that personal life insurance premiums are not tax deductible¹. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

The IRS deducts qualified medical expenses. In other words funeral expenses are tax deductible if they are covered by an estate. The estate itself must also be large enough to accrue tax liability in order to claim the deduction.

Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. While individuals cannot deduct funeral expenses eligible estates may be able to. Can I deduct funeral expenses probate fees or fees to administer the estate.

When completing your tax return youre able to claim deductions for some expenses. Burial and funeral expenses however are a bit more complex. Generally funeral expenses cannot be deducted for income tax purposes whether they are paid directly by the individual or through the estate as.

However if the expenses are paid from an individuals estate that it will be tax-deductible. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. Are funeral expenses tax deductible in Australia.

Aside from floral cost the cost of funerals including cremation casket hearse limousines and embalming is deductible for all funeral expenses including funeral urns. These are costs you incur to earn your employment income. Well go over these in our next section below.

June 3 2019 1228 PM. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. To find out what guides are available.

Yes funeral expenses are a personal expense so the family or the trust cant claim them. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes.

Most are work-related expenses. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. When a person dies generally the person responsible for administering the deceased estate is the legal personal representative.

As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible. Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return. There are no inheritance or estate taxes in Australia.

Many estates do not actually use this deduction since most estates are less than the amount that is taxable. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. What expenses can I.

Deductions you can claim. According to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate. No never can funeral expenses be claimed on taxes as a deduction.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. In short these expenses are not eligible to be claimed on a 1040 tax form. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs.

This means that you cannot deduct the cost of a funeral from your individual tax returns. We translate some common expenses in other languages to help people from non-English speaking backgrounds. Deductible medical expenses may include but are not limited to the following.

In this case your fund pays a third-party provider for life insurance on your behalf. These are personal expenses and cannot be deducted. This means that you can not deduct the cost of a funeral from your individual tax returns.

Funeral expenses are not tax-deductible. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. Are Cremation And Funeral Expenses Tax Deductible.

As well as claims against the estates certain taxes and certain debts incurred since July 1 2005. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. At the time of estate settling you can claim a tax deduction for the funeral expenses.

While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs.

11 Types Of Tax Incentives How They Differ In Their Functionality Income Tax Income Tax Return Tax Refund

Are Funeral Costs Tax Deductible In Australia Ictsd Org

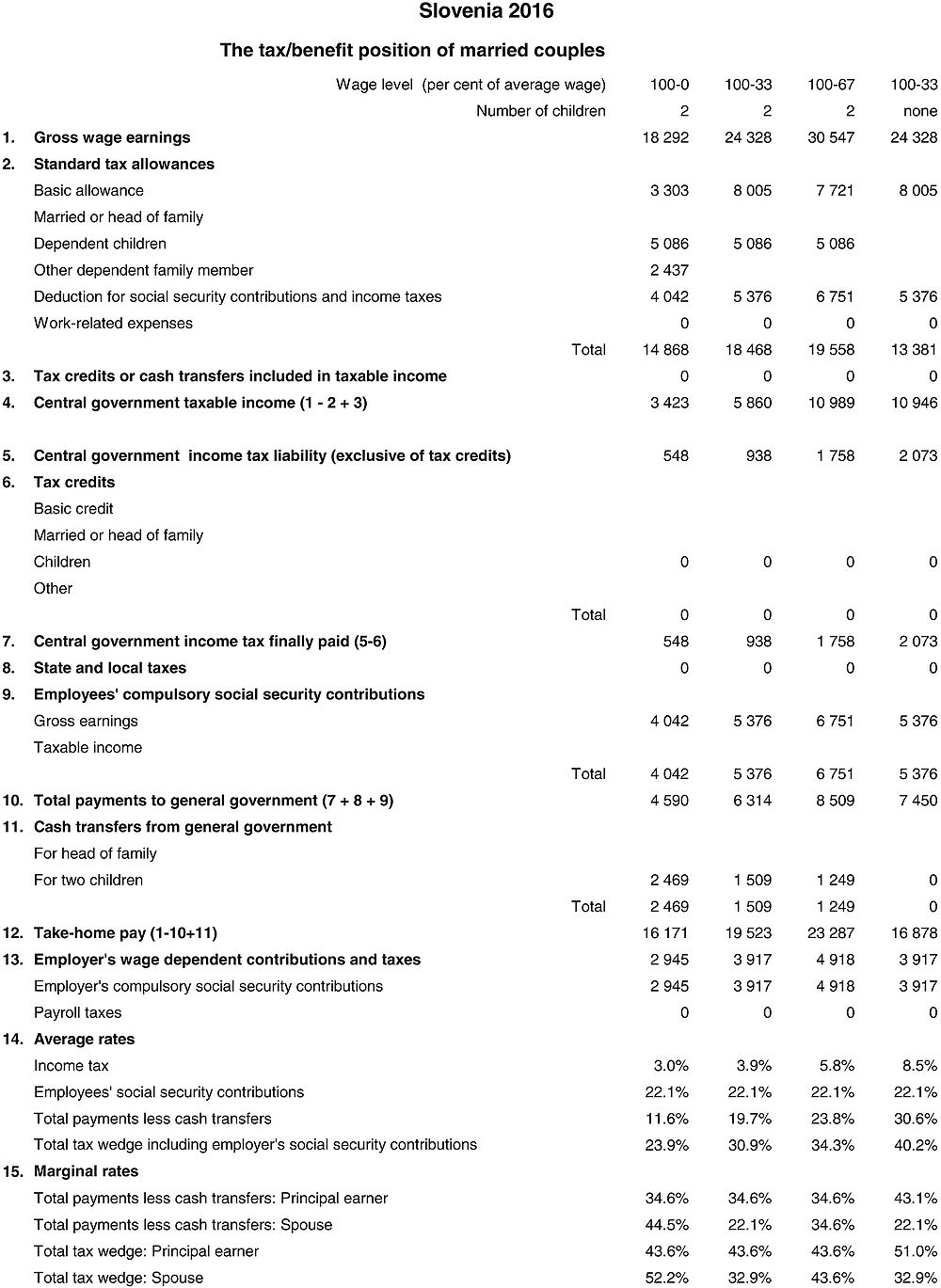

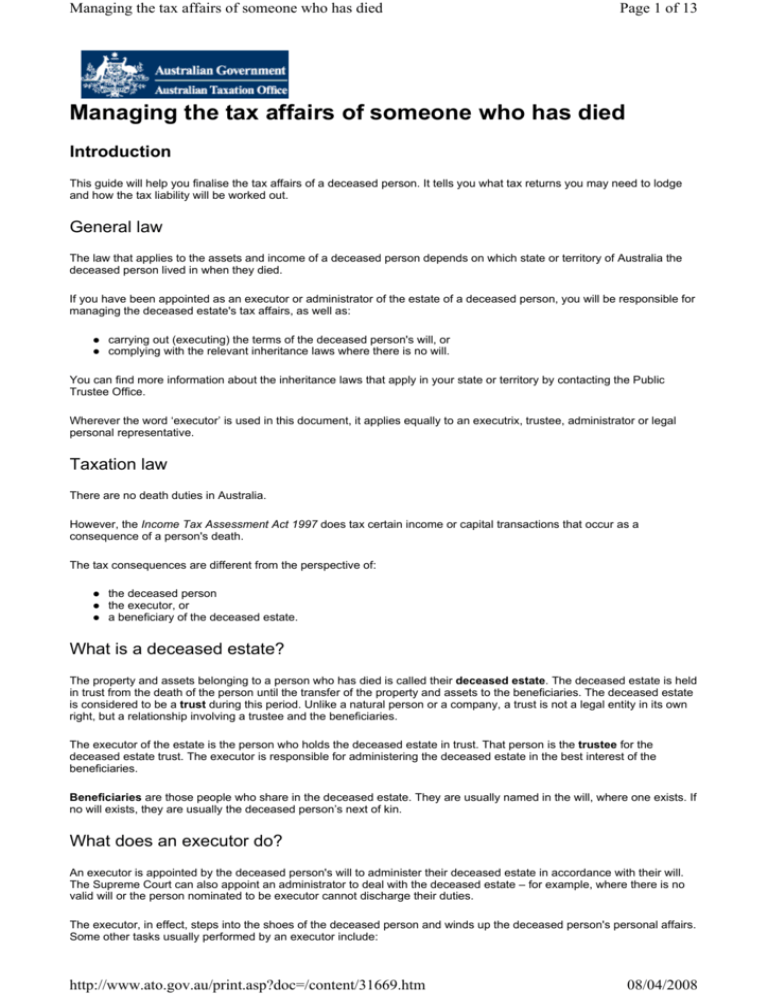

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

What Tax Deductions Can I Claim Go To Court Lawyers

Do You Have To Report 401k On Tax Return It Depends

Are Funeral Costs Tax Deductible In Australia Ictsd Org

Reforming Tax Expenditures In Italy What Why And How In Imf Working Papers Volume 2014 Issue 007 2014

Two Easy Ways To Maximise Your Tax Refund Aps Benefits Group

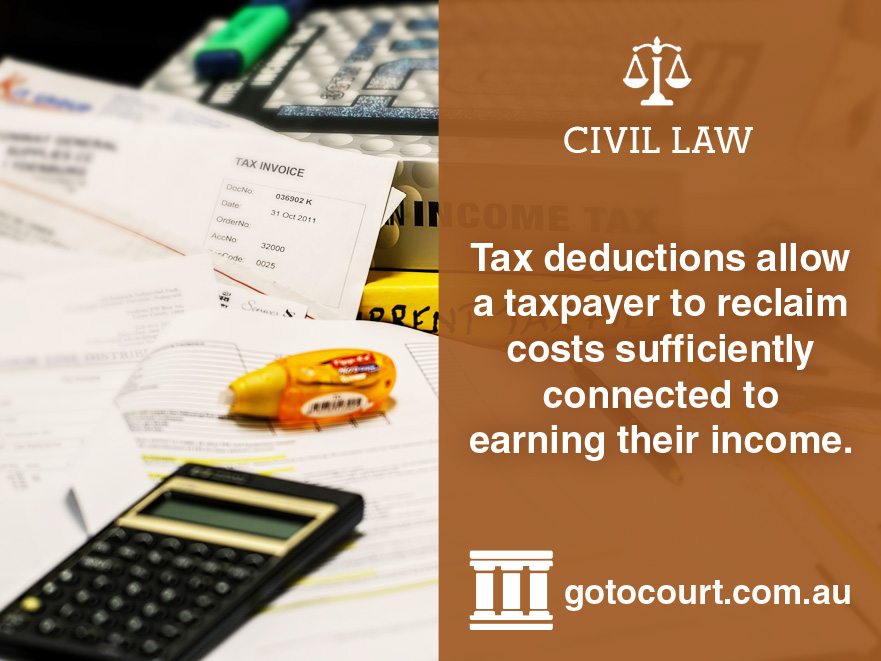

Managing The Tax Affairs Of Someone Who Has Died Ato Fact Sheet